America Must Accept a Program of Full Employment for All Citizens

Adding to the Popularity of the Keynesian revolution.

- Here's How to Achieve Full Employment.

- Here's How to Achieve Full Employment.

- ;

- ;

- .

The mobilization of the war economy would, once hostilities were over, be turned around as the basis of a new civilian economy that was much bigger, more diverse and better organized than the pre-war economy during even the pre-depression years of the roaring s. Concrete benefits include long distance hauling of products especially of produce, warehousing, and the internationalization of US production and capital to pave the way for US multinational company take-over of key international and regional markets in Western Europe, the Middle East, Latin America and the Far East or South East Asia.

To pro-Keynesian economists, the most important thing was the government war expenditure represented the classic case for expanding G to solve protracted unemployment and bring the economy into full production. Government macro-management has some bragging rights: The long and deep recessions or depression of the s have not reoccurred since the inception of government intervention in the mids. Meaning that government intervention which was meant to be periodic, a temporary "fine-tuning" measure, has become institutionalized so that at anytime since the Great Depression, the US economy like that of all other market oriented economies has been under one or the other form of government macro economic policy.

But there is a cost to everything: The downside of permanent government macro-management of money economies is that it attempts to take credit whenever the market is strong and stable, something often denied for political reasons but unable to shake off the blame whenever the economy goes soft and is unstable. Keynesian Revolution and the Full Employment Act of And that for a number of reasons: The act provided immediate solutions to avert the recurrence of yet another serious recession following the War.

The Act sealed the doom of the self-regulatory market system for decades to come.

The Federal Job Guarantee - A Policy to Achieve Permanent Full Employment

From that time forward, the idea that the market, when left on its own, could be trusted to remain stable was forever discredited as a sound economic theory. But above all, the Full Employment Act is remembered for creating a new political economy climate in the country which endorsed government intervention as part of the normal workings of a capitalist system and encouraged the workforce for the first time in U. And this as a new constitutional right every American can demand of his or her government.

The Act institutionalized an economic subpresidency, meaning it extended as constitutional obligation of the government in general but of the president in particular the task of hence forth macro-managing the economy to ensure stability and full employment at all times.

These executive institutions were duplicated by rivalrous Congressional economic institutions: What should we know about these institutions? When they were instituted and for what purpose; Whether they form part of the economic subpresidency or belong under Congressional oversight, and what their main functions are, especially, as they may relate to the main task of successfully and efficiently macro-managing the economy to ensure stability over time.

It is also useful to know who the current directors are but this is not a requirement for puzzles or exam. The Office of Management and Budget: Institutional law and purpose: Current Director is Dr. As a result the OBM has gained hard-nose reputation for cutting government waste.

Established in the Full Employment Act of , the CEA is there to advise the president on economic policy that would do the good job of keeping the GDP away from periods of protracted unemployment and inflation — the ideal macroeconomic role for the government as envisaged by Keynes. The current director of the CEA is Dr. Created as far back as the Washington Administration, the Treasury Dept. Is the oldest of the economic sub-presidential institutions. Its most important function is the collecting of government revenue through the Internal Revenue Service IRS and the payment of government bills, government borrowing and securing government credit.

It shares with the OMB the role of government to avoid deficits and so ensure balanced budgets. As such, only a person with outstanding background on both wall- and main-street is seconded to this post. The current Treasury Secretary is Dr.

The Federal Reserve System. Created originally in , the Federal Reserve System, the central bank of the United States, was in the Full Employment Act reconstituted and entrusted with the key roll of managing the monetary policies of the government to become a key member of the economic subpresident institutional trio the Treasury is regarded as the fourth.

The Federal Reserve System is designed for maximum independence from other branches of government, especially, the executive presidency, in order to suggest the independence of monetary policy from political controls, especially of the sitting president. The functions of the Fed include: As the Central Bank of the United States: Activities of Foreign Banking Organizations. Acquisitions and Mergers FIC. As the instrument of Monetary Policy as mandated by the Full Employment act: The Federal Reserve in the International Sphere.

International Linkages with other central banks throughout the world. Congressional Responsibility for the Macroeconomy: Even though unlike the President elected by all, Congressional Representatives are elected to look after the specific interests of their districts and Senators their states, they still must care a lot for the Macroeconomy for three reasons: Unless the whole economy is sound and healthy, their parochial economic districts cannot be sound and healthy. One could go further than the new executive order and bar violators from Federal contractors, as amendments attached to the defense and transportation bills in the House last year required.

There are a variety of other policies that can support wage growth. Too many workers are deemed independent contractors by their employers when they are really employees. These practices are particularly severe in construction. Rampant misclassification also undercuts the ability of employers who follow the law to win bidded contracts, thereby lowering the wages of workers in their firms.

We have also seen efforts to undercut prevailing wage laws at the federal and state levels. Efforts to improve labor standards enforcement, end misclassification the Department of Labor has a multi-state initiative on this , and protect and strengthen prevailing wage laws can end wage theft and support wage growth. The failure of wages to grow cannot be cured through tax cuts. Such policies are sometimes offered as propelling long-run job gains and economic growth though they are not aimed at securing a stronger recovery from a recession, as the conservatives who offer tax cuts do not believe in counter-cyclical fiscal policy.

These policies are not effective tools to promote growth, but even if they did create growth, it is clear that growth by itself will not lift wages of the typical worker. After all, we have seen plenty of productivity growth since , but very little wage growth for the vast majority of workers. That is, tax cuts are a tried and failed policy that does not change the dynamics of the labor market so that workers will gain from productivity.

Corporate tax reform, as discussed above, holds little promise of promoting economic growth, let alone generating wage growth. In short, there is no basis for believing that expanded corporate profitability will necessarily benefit the typical worker. Providing tax cuts is also seen as a way to provide some cash to ease the financial struggles of families. This is understandable, as such policies seem readily doable to congressional policymakers. The problem is that wage stagnation is an ongoing challenge and one-time tax cuts are, at best, a short-term Band-Aid.

Moreover, tax cuts erode revenues needed for many unmet needs, such as increasing public investment and supporting social insurance programs. Facilitating more people attending and completing higher levels of education, or other types of training e. It can help fuel economic growth in the future, and it can expand access to better jobs for low- and middle-income children who would not otherwise have those opportunities.

But advancing education completion is not an effective overall policy to generate higher wages. Some who attain higher credentials will earn more. Recall that the wages of college graduates have been stagnant for over 10 years and the wages accepted by recent college graduates have been lower than those graduating in earlier years and with fewer employer-provided benefits.

This means that increasing college completion to any great degree will mean that the wages of college graduates will be falling, especially among men and newer graduates. This will lead to less inequality, but it is not a generalized recipe for wage growth. There is no reason to believe that everyone who completes a college degree will be able to obtain a job that requires such an education. If not, college graduates will increasingly be used in jobs that those with less education now perform.

The same analysis is true for community college completion. Providing access will help many attain the opportunities for jobs previously unavailable to low- and moderate-income students, facilitating intergenerational mobility. Community college graduates now earn 7. The share of the workforce with community college degrees has expanded from 7.

Wage growth

At the same time, the fact that the wages of community college graduates relative to high school graduates i. This is an avenue to help some workers, but not a generalized approach to raising wages. What is needed are policies that lift wages of high school graduates, community college graduates, and college graduates, not simply a policy that changes the number of workers in each category. There is no solid basis for believing that deregulation will lead to greater productivity growth or that doing so will lead to wage growth.

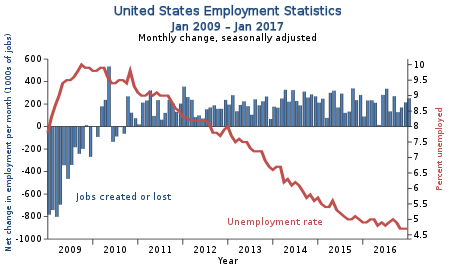

Deregulation of finance certainly was a major factor in the financial crisis and relaxing Dodd—Frank rules will only make our economy more susceptible to crisis. Policies that can substantially help reduce unemployment in the next two years are welcomed and can serve to raise wage growth. Policies aimed at raising longer-term growth prospects may be beneficial but will not help wages soon or necessarily lead to wage growth in future years. This can be seen in the decoupling of wage growth from productivity over the last 40 years. Simply increasing investments and productivity will not necessarily improve the wages of a typical worker.

What is missing are mechanisms that relink productivity and wage growth. Lawrence Mishel is president of the Economic Policy Institute , an independent, nonprofit, nonpartisan think tank that researches the impact of economic trends and policies on working people in the United States and around the world. EPI's mission is to inform people and empower them to seek solutions that will ensure broadly shared prosperity and opportunity.

Skip to main content.

You are here

Home Magazine Blogs Tapped: Lawrence Mishel February 6, If we don't get there, then many communities—particularly those of color—will be left out of the recovery. You may also like. The Worst Mistake of Their Lives. They thought Donald Trump could offer them redemption. Instead, they lost everything. The Trump Scandals Were Inevitable. A job guarantee would enable workers, particularly at the lower end of the labor market, but throughout the labor market too.

It would remove the threat of unemployment and of being destitute.

Guaranteed "Jobs for All" Program Is Gaining Traction Among Democratic Hopefuls

By making living-wage work available to anyone who wants it, the program would also establish a de facto wage floor, forcing private sector employers to match the kinds of wages, working conditions, and benefits available to workers through the public sector. As savvy politicians are starting to realize, embracing big spending could be an electoral boon.

The idea enjoys overwhelming support across state lines and has comparable backing among rural and urban voters. The sheer scale of such a program also flies in the face of how policy gets made in Washington. How much money will it add to the federal deficit? Yet the sticker price of a policy is just one of many factors that contribute to its overall effect on the economy and society more broadly: Does it, for instance, meet a pressing public need?

Will it increase or decrease inequality? She proposed a rebranding: A common response among progressives, instead, has been to present their policies as a two-step process: Tax the bad — corporate profits, financial sector speculation, offshore earnings, etc. Go after the rich — fight to return the estate tax to some reasonable level, for instance. There are signs that decoupling may be starting to catch on. Discussing his ambitious plan for debt-free higher education, Sen. Bush blew up the deficit for his wars and his tax cuts.

Barack Obama tied himself in knots trying to be the responsible deficit cutter. First as tragedy, then as farce, now as Donald Trump. When he was diagnosed with ALS in late , Barkan was working with the Center for Popular Democracy on a campaign to reform the Federal Reserve and American monetary policymaking with it.

Roosevelt signs the Social Security bill in Washington D. The first tenet of Franklin D. Those new institutions express themselves in different forms, depending on their historical moment.