Finding the Greater Fool

Seems when central banks take the cheap-money punch bowl away, everything turns to crap. Double that in Toronto or Van. Compare us to the States, where a brief bout of house lust resulted in a national spankfest with apparently lasting consequences. Sit down and grab something secure while you read the following summary of available listings in five major American cities.

Chicago , population 2. Miami , population 2. Philadelphia , population 1.

- Paca (Spanish Edition).

- Fastnachtspiel: Stoffe, Motive, Charaktere (German Edition).

- No customer reviews.

- The Greater Fool Theory.

Apples are not oranges and the States is not Canada, but our two countries are among the most similar on the planet. So the difference in real estate values and household debt is worth noting. This is what FOMO, financial illiteracy and trashy lenders have wrought. National home sales faded 2. Across this entire frosty land, prices have dropped for six months straight, back to mid levels. Despite supportive economic and demographic fundamentals, national home sales have begun trending lower.

While national home sales were anticipated to recover in the wake of a large drop in activity earlier this year due to the introduction of the stress-test, the rebound appears to have run its course. There are more clouds now. The oil mess in Alberta. Rising interest rates in both Canada and the US another one this week.

The silly, pointless Meng arrest. The most indebted households in the world. Remember the blog motto: That the real estate market would disappoint is a given. Sellers today can still do well. Buyers are rolling the dice. And the entire industry is scared.

- Throwbacks: Old-School Baseball Players in Todays Game.

- Garth’s Recent Postings.

- Turbulence in the River.

- ELIAS An Epic of the Ages.

- Anna Cannot Sleep: Early Readers Wonder Series;

- Navigation menu.

MPs and T2 are under big pressure to relent, and probably will. As reported here, the pace of rate hikes will slow and shudder to a halt. Sometimes even if you do everything right you can still lose. In my story, I did my due diligence and completely understood what I was purchasing, but I still lost money. This was a result of my beliefs of where the ETF and the economy would go, which were wrong.

There are a ton of great resources out there for simple and efficient portfolios. Three-fund portfolio — The Bogleheads wiki for the three-fund portfolio strategy is solid.

Greater fool theory

And while I hit some home runs, they were canceled out by some duds. All in all, I under performed the market by a half point. So, why waste your time? In hindsight, I could have used that energy to focus more on real estate investing while earning more with a passive index investing approach. Ah well, you live and learn!

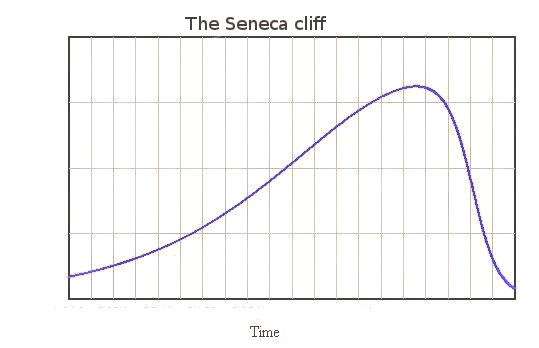

Underperforming by only half a point actually sounds pretty excellent, based on some of these stats haha. That passive index approach is something I just recently discovered too, and it makes life a whole heck of a lot easier. I am so boring in my investments. Ah man, stuff like that scares me a bit. The Greater Fool Theory As defined by Investopedia , the greater fool theory states that you can make money buying securities because there will always be someone on the other end who is willing to pay a higher price than you i.

Greater Fool Theory

Timing the Market Simply put, timing the market means speculating on when the market will go up and down. Does this mean that investing has to be dull and boring? There are plenty of stocks that are fairly priced, or even underpriced, and are still capable of blasting off like a rocket. The smart approach is to buy them when they are cheap, and sell them when they are fairly valued.

Greater fool theory - Wikipedia

So how can you know which stocks are overpriced and which ones are underpriced? There are many stock screening tools out there, and some of them are free, at least in a dumbed-down version. Morningstar, Zacks, and your local broker are good places to look. I keep my own list, which I update weekly and share with clients and subscribers to my newsletter.

If you would like to see the latest list of 10 most overpriced and 10 most underpriced stocks, send me an email at info zeninvesor. Former head of equity trading, Northern Trust Bank, Chicago. Teacher, trainer, mentor, market historian, and perpetual student of all things related to the stock market and excellence in investing.

Hi, I would like to have a list of the over priced and under priced stock. Could you kindly send it to me?

What is the Greater Fool Theory?

Thank you very much for the info. Your greater fool theory explanation is much appreciated. Save my name, email, and website in this browser for the next time I comment.